EUROPE-LONDON, U.K.- London think tank: If Robredo takes over an incapacitated Duterte, investors to be lured to PH

.

.

In case Vice President Leni Robredo replaces President Rodrigo Duterte due to health issues hounding Duterte, London-based Capital Economics sees the likelihood of more foreign investors being lured into the Philippines.

Gareth Leather, Capital Economics senior Asia economist, said in a report taht while the think tank doesn’t know much about the direction Robredo would take economically, “a change in President would probably be welcomed by investors.”

Leather, in the report titled “Duterte health worries, Sri Lanka election,” said Robredo was known to have a “fierce opposition to Duterte’s authoritarian tendencies, including his willingness to undermine political institutions.”

BELOW IS RESERVE FOR YOUR ADVERTISEMENT –

“Since Duterte took office, approved foreign investments have been much lower than previous years,” Leather said, citing Philippine Statistics Authority (PSA) data on investment promotion agencies’ (IPA) approvals of foreign-led projects seeking tax incentives and other perks.

BELOW IS RESERVE FOR YOUR ADVERTISEMENT –

Leather noted that “if Duterte is either incapacitated or dies in office,” Robredo—who also leads the opposition—will be his successor under the Philippine Constitution.

BELOW IS RESERVE FOR YOUR ADVERTISEMENT –

“That is not to say, however, that Duterte’s presidency has been a disaster for the economy. His massive popularity has enabled him to pass reforms that might not have otherwise made it through Congress,” according to Leather.

Leather noted that Duterte signed into law the “controversial” Tax Reform for Acceleration and Inclusion (TRAIN) Act, which nonetheless “helped to fund a big increase in infrastructure spending.”

The TRAIN law being implemented since last year slapped new or higher taxes on various goods and services—including oil products, motor vehicles, sugary drinks, cosmetic procedures, among others—to compensate for the lower personal income tax rates.

“Also important has been the liberalization of the rice import regime, which has helped bring down inflation and should help raise productivity in the agricultural sector by exposing it to more competition,” Leather added./Edited by TSB

BELOW IS RESERVE FOR YOUR ADVERTISEMENT –

.

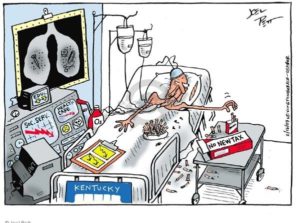

All photographs, news, editorials, opinions, information, data, others have been taken from the Internet .. | For COMMENTS- Jared Pitt