Several domestic and foreign factors are eroding the value of the peso against the US currency and they may further weigh down on the peso toward the end of the year.

The peso on Wednesday dropped below 53 against the US dollar, the local currency’s lowest level in nearly 12 years. The peso has lost about 6 percent of its value against the US dollar, or more than the full-year depreciation of 5.4 percent and 4.7 percent in 2016 and 2015 respectively, making it the weakest currency in Asia, excluding Japan.

Analysts are quick to point out that the ballooning trade deficit is greatly weakening the value of the peso. The trend has prompted DBS Bank of Singapore to predict that the peso may depreciate further to 54 per US dollar by the end of the year.

The trade deficit widened to a cumulative $12.2 billion in the first four months of 2018 after imports rose 10.5 percent while exports fell 6.2 percent. This implies that more dollars are being spent overseas by importers compared with the foreign exchange earnings of exporters, resulting in the reduced supply of the US currency in the local financial market. More imports are coming in because of the demand in the local economy, partly triggered by the capital equipment requirements of the government’s massive infrastructure program.

Foreign fund managers, meanwhile, are avoiding emerging markets like the Philippines in favor of US dollar-based investment instruments. Higher interest rates in the US have made the American currency more attractive in terms of investment returns, weakening the value of the peso in the process.

Currency speculation may also be undermining the value of the peso. Philippine companies could already be hedging or buying dollars for their future requirements at a higher cost in anticipation of a further weakening of the peso. The same may be true with Filipinos working overseas, who could be delaying their remittances to the Philippines for a better exchange rate.

The Bangko Sentral ng Pilipinas could stem the tide and “defend” the peso through another increase in interest rates. Higher local interest rates may slow down the peso depreciation—which is inflationary—but they will raise the cost of borrowing and dampen the expansion plan of companies. It is a delicate balancing act that the Bangko Sentral must perform. / posted June 15, 2018 at 12:50 am by Manila Standard

.

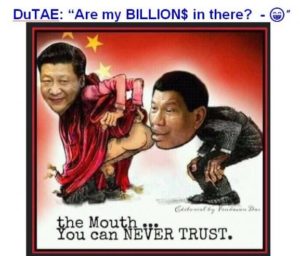

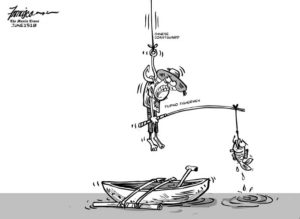

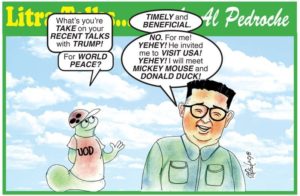

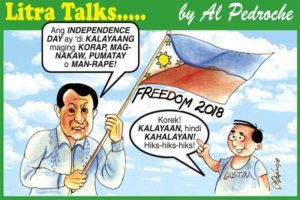

ASEANEWS EDITORIAL CARTOONS:.

All photographs, news, editorials, opinions, information, data, others have been taken from the Internet ..aseanews.net | [email protected] |.For comments, Email to :D’Equalizer | [email protected] | Contributor

All photographs, news, editorials, opinions, information, data, others have been taken from the Internet ..aseanews.net | [email protected] |.For comments, Email to :D’Equalizer | [email protected] | Contributor