ASIAN STOCK MARKET: Philippine Stocks Start 2020 as Most Unloved: Expect a weaker peso and fears of regulatory risk

.

ADS by Cloud 9:

– SPACE RESERVE FOR YOUR ADVERTISEMENT –

.

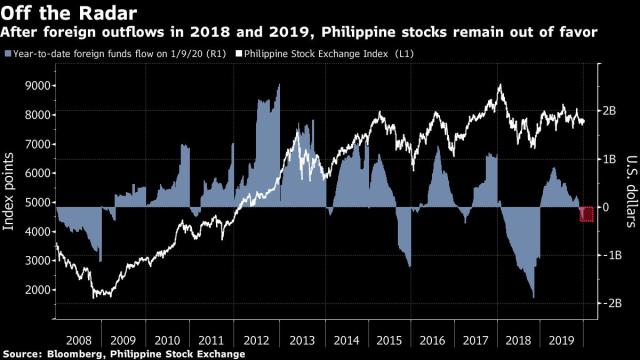

Barely two weeks into the new year, and the market is the worst performer among major Asian peers, with overseas fund withdrawals reminiscent of January 2008. Back then, fears of a U.S. recession roiled global shares and pummeled Manila into a bear market. Last year, Philippine equities were already among the region’s laggards.

.

.

ADS by Cloud 9:

– SPACE RESERVE FOR YOUR ADVERTISEMENT –

Expectations of a weaker peso and fears of regulatory risk over a contract dispute between the government and Manila’s water utilities could be holding back investors from scooping up Philippine equities, even amid the prospects of faster economic growth, according to Rachelle Cruz, an analyst at AP Securities Inc. An added factor is the uncertainty over the passage of measures cutting corporate taxes and incentives, she said.

After clocking a 4.7% gain in 2019 (the regional benchmark surged 16%), the Philippine Stock Exchange Index has retreated 0.5% this year as overseas funds have pulled $44 million, one of the biggest outflow in Asia. Foreign investors dumped almost $100 million over a similar period at the start of 2008, just as the index was about to sink into a bear market.

The Philippine stock exchange suspended trading Monday after the government said there’s an imminent threat of a hazardous eruption of the Taal Volcano, now rumbling and spewing ash and smoke just 65 kilometers (40 miles) south of the capital Manila.

Foreign investors have pulled more than $1.3 billion from Philippine equity funds in the last two years as the nation was hit by rising inflation and slowing economic growth, coupled with sell-offs triggered by a U.S.-China trade war. While the shares have traded at a premium to Asian peers for most of the past decade, the rout shrank valuations to the lowest since 2011 relative to the MSCI Asia Pacific Index, feeding hopes bargain hunters will come in.

.

ADS by Cloud 9:

– SPACE RESERVE FOR YOUR ADVERTISEMENT –

“This outflow isn’t a reflection of deteriorating fundamentals, but the tail-end of a portfolio re-balancing,” said Cristina Ulang, an analyst at First Metro Investment Corp. “This could be an inflection point for there are many arguments why foreign investors will come back this year. Economic growth and corporate earnings will be stronger. We are again in the league of Asia’s fastest growing markets.” / Bloomberg 19 hours ago

© 2020 Bloomberg L.P.

.

ADS by Cloud 9:

– SPACE RESERVE FOR YOUR ADVERTISEMENT –