BIZ-WIRECARD FIASCO: MANILA- Banks tighten processes amid Wirecard scandal

MANILA, Philippines — Philippine banks are further tightening procedures after two of the country’s lar-gest lenders were dragged into the reported $2.1 billion missing funds of German financial technology leader Wirecard AG.

Cezar Consing, president and chief operating officer at BPI, said they are strengthening policies and programs that encourage good conduct and discourage bad process after the Ayala-led bank was dragged into the accounting scandal.

“Our processes and procedures in connection with the issuance of banking certifications are very stringent. Thus, we can readily detect when certificates are spurious, as was the case with Wirecard,” Consing said.

Consing, who is also president of the Bankers Association of the Philippine (BAP), said BPI has already terminated a junior officer who was earlier placed on preventive suspension for allegedly issuing the fraudulent document.

“This was a case of bad conduct on the part of a very junior officer who has since been terminated,” Consing said.

Bangko Sentral ng Pilipinas Governor Benjamin Diokno has directed banks to strengthen their know-your-customer protocols as well as their compliance and internal audit functions to assess the behaviors of employees and financial transactions.

Diokno, who also chairs the Anti-Money Laundering Council (AMLC), earlier said none of the missing $2.1 billion entered the Philippine financial system.

Banks are mandated to submit suspicious transaction reports (STRs) to the AMLC for transactions exceeding P500,000 as such amount triggers the filing of a covered transaction report.

Mel Georgie Racela, executive director of the AMLC Secretariat, said the body would focus on the money laundering aspect of the investigation, while the Department of Justice (DOJ) and the National Bureau of Investigation (NBI) would look into other offenses.

The Anti-Money Laundering Act of 2001 (AMLA), as amended, mandates the AMLC to make sure that the Philippines is not used as a money laundering site for the proceeds of any unlawful act.

Justice Secretary Menardo Guevarra announced Wednesday that the NBI and the AMLC would look into “certain individuals” because of transactions that showed “monies entered the local account of a person in the Philippines who has links with Wirecard.

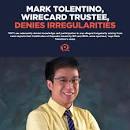

The NBI has summoned former Department of Transportation assistant secretary Mark Tolentino to shed light on his alleged involvement in the Wirecard scandal.

Tolentino through his law firm M.K Tolentino Law and Business Consultancy Office reportedly served as trustee of the Wirecard accounts./ The Philippine Star

SIGN UP TO RECEIVE OUR EMAIL

.

The most important news of the day about the ASEAN Countries and the world in one email: [email protected]

6.29.2020