FAMILY-HEALTH: The dilemma of parents raising artistically-inclined children

RAISING CHILDREN WITH HIGH FQ – Rose Fres Fausto

Last weekend my son Enrique celebrated his milestone birthday with the theme A Night of Music and Poetry. It was a wonderful night watching him and his friends render songs, poetry, rap, etc. What made it more special was that I saw most of these kids grow up, some since they were in high school, others as early as grade school. In terms of talent, that night was full house! (If you want to see snippets of their performances, please go to FQMom FB Page link.)

Appreciating their artistic talents got me thinking. How many of our kids really get to pursue art as their profession, as their source of livelihood? Not many parents are comfortable with their children pursuing the “uncertain” field of art that they would say, “Naku, lahat ng anakkomahiligsa arts, kailangan pa kamingkumayod mag-asawa!” (“Oh no, all my kids are into arts, my spouse and I still need to earn a living!”)

Others would directly order their children not to get into it. I heard the story of a very successful musician whose mother made him promise in her dying bed never to pursue a career in music because “gutomangaabutinmodyan!” (“You will just go hungry!”)

.

– YOUR ADVERTISEMENT HERE –

Another great painter, whose children all turned out to be artistically inclined, ordered them not to take up art courses but Science and Business with the intention of protecting his children from “gutom” (hunger). Only the youngest was allowed to pursue arts because the father felt that this child might not be able to handle courses in Science and Business. Today the youngest is the most successful among the children.

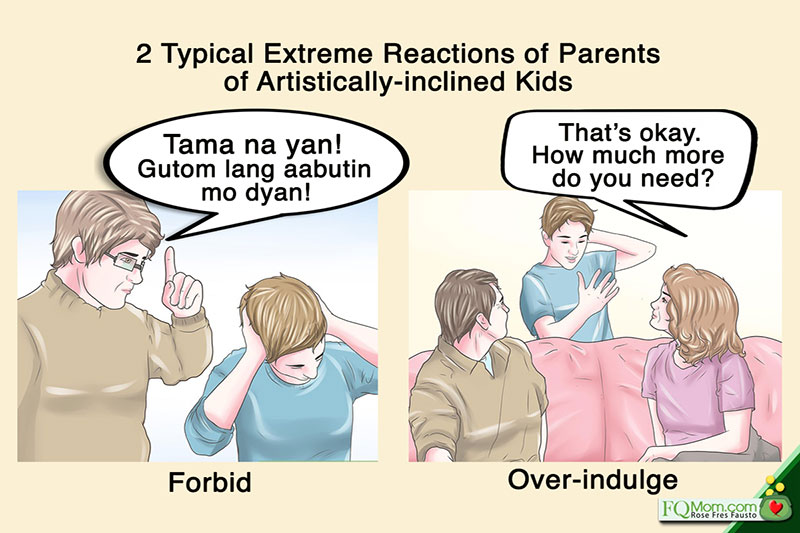

Can we blame parents for feeling this way? There are two typical reactions of parents with artistically-inclined children as we saw in the above stories.

- Forbid their children to pursue the arts.Because they want their children to “succeed” they re-direct them to the more familiar fields where income is more certain.

- Overindulge and not cut the financial umbilical cord. Because they know that there’s no stability in the income stream of arts, they over-provide for their children, still giving allowance until God knows when.

.

If you’re a parent of a child who wants to pursue a career in arts, which one is your reaction?

If you’re a parent of a child who wants to pursue a career in arts, which one is your reaction?

If you take a look at the two reactions, parents are just trying to protect their children from the realities of money problems.

I am proposing a long-term solution to this problem. And this is a pro-active solution that should be done from the very start, if possible from the time they are born:Raise your children to have high FQ. Doing so is arming them with Economic Self-Defense.

.

This is one of the author’s favorite lines.

This is one of the author’s favorite lines.

How do you do this?

From the time they are born, open a bank account for them where you will deposit all their cash gifts. In fact, invest all their cash gifts in higher yielding financial instruments like equity index funds or bonds (back in the day, we had “double your money” fixed income instruments where we also invested our sons’ money).

Then as your children get older, teach them thebasic laws of money, and put these laws into action starting with allowance, summer jobs, recording of expenses, and the other FQ parenting tips I’ve shared in previous articles.

If you download the free excel file that I always share for parents to show their kidsthe magic of compounding, it will be easier for them to follow the basic laws of money.

.

Here’s the clincher. By the time your child graduates from college and wants to pursue a career in the “uncertain” field of arts, you don’t have to do either of the two extreme parental reactions stated above.

If you raised your child saving and investing regularly, it is actually possible for him to have accumulated a million pesos upon graduation(Click link). Even if he just gets to accumulate a fraction of that, it will already be a good buffer to live on for a college graduate without loans to pay off.

He can continue to stay with you at home and enjoy free board and lodging, with the bonus of free advice from the people who really care and want him to succeed.

Let’s do some computations. With free board and lodging, your child’s monthly budget can be anywhere from P10,000 – P15,000 per month. Let’s say he didn’t accumulate a million but a quarter of it, he can survive for 17 – 25 months. That’s a good two years. This can be longer if he accumulated more. As his funds dwindle, he can earn something on the side.

Again, no need to resort to any of the extreme actions above. No need to forbid him from pursuing his gift. No need to make him a dependent forever. I still say, “Cut his financial umbilical cord as soon as he graduates from college.”

But what if your child is about to graduate and you feel that you failed to raise him with high FQ who can delay gratification? What if he did not accumulate six figures?

Well, then start now. If he has zero net asset value, tighten the belt,no luxuries. Forget YOLO. Do some computations, and come up with a deadline for receiving allowance from you. Make the timeframe short, because a college graduate has all the capacity to earn a living. If the job that’s available is not what he wants to do, then he will just have to improvise. He should take the job then side hustle.

.

To those with newborn or very young kids, come and join me in raising a generation of High FQ individuals. I tell you, once you raise them to have high FQ (and of course, to be kind and respectful individuals), you can sit back and relax, not get in the way of their pursuit of their calling, because you know that they will be financially okay. You know you have already armed them with that all important 21st century skill called High FQ!

image: https://media.philstar.com/images/the-philippine-star/lifestyle/health-and-family/20180321/Wallet-icon.jpg

![]()

********************

ANNOUNCEMENTS

If there’s a book that I highly recommend to individuals pursuing a career as an artist, it’s Real Artists Don’t Starve (Timeless Strategies for Thriving in the New Creative Age) by Jeff Goins. In fact, the lessons there are applicable to many professions that have to do with putting value in their work.

Want to know your FQ Score? Take it today. Click link to take the test. http://rebrand.ly/FQTest

Rose FresFausto is a speaker and author of bestselling books Raising Pinoy Boys and The Retelling of The Richest Man in Babylon (English and Filipino versions). Click this link to read samples –Books of FQ Mom. She is a Behavioral Economist, Certified Gallup Strengths Coach and the grand prize winner of the first Sinag Financial Literacy Digital Journalism Awards. Follow her on Facebook & YouTube as FQ Mom, and Twitter&Instagram as the FQ Mom. / The Philippine Star – March 21, 2018 – 12:00am

All photographs, news, editorials, opinions, information, data, others have been taken from the Internet ..aseanews.net | [email protected] / For comments, Email to : Aseanews.Net | [email protected] | Contributor:-