OVERSEAS IMMIGRANT WORKERS-OIW: LOS ANGELES- Immigrants Keep Sending Money Home Despite Pandemic Job Losses

LOS ANGELES — Jesus Perlera’s pay from hauling shipping containers to and from the port of Oakland, California, plummeted in the spring as the coronavirus pandemic ravaged business. But through the shaky months, the self-employed trucker never stopped sending money to his mother in El Salvador..

“If I don’t support her,” he said, “how will she eat?”

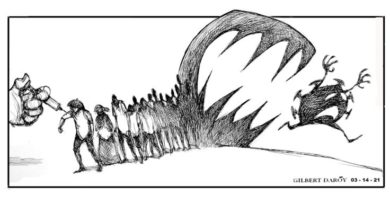

Perlera and many other immigrants like him have managed to continue sending substantial amounts of money home, even after the coronavirus pushed their own jobs and earnings into free fall — belying early warnings of a dire global consequence from the pandemic.

The World Bank had predicted in April that remittances transferred to Latin America and the Caribbean by immigrants would plunge by almost 20% this year, “their sharpest decline in recent history,” as workers were laid off or their hours slashed. But that forecast, as well as others from international financial analysts, is unlikely to materialize if current trends hold.

The predictions made sense. Remittances historically have risen and fallen with the fortunes of the economies where immigrants have traveled to work.

But after weathering the worst months of the lockdown, many immigrants are back on the job and sending their relatives even more money than before the downturn, according to newly compiled estimates.

.

“Everybody was talking about how remittances would drop, yet they have remained remarkably strong,” said Matt Oppenheimer, chief executive of Remitly, a digital money transfer company based in Seattle.

After dropping precipitously in March and April, remittances to Latin America, about three-quarters of which are sent by immigrants working in the United States, have rebounded. The money transferred to some of those countries in the first half of 2020 actually eclipsed the amount sent during the same period in 2019, according to official data.

Remittances from Indians, Filipinos and Nigerians in the United States have also continued to grow relative to last year, according to executives at money transfer companies who track such transfers.

The unexpected results underscore the resilience of immigrants, their capacity to navigate through turbulent times and their sense of obligation to relatives they left behind.

.

“It’s counterintuitive to most Americans,” Oppenheimer said. “But for immigrants, supporting their families back home is the fundamental reason they came here in the first place.”

Elias Bruno, 31, a construction worker in Panama City, Florida, supports five people in Mexico. The contractor who regularly employs him has fewer projects than before the pandemic, but rather than remain idle, Bruno said he had been stationing himself outside a hardware store, where he waits for a homeowner or another contractor to hire him for day work.

“We are struggling here, but it’s worse in Mexico,” Bruno said. “You have to make every sacrifice to feed your family.”

He has been sending them at least $200 a month.

Jason Go, a Filipino cardiologist in Grand Forks, North Dakota, said that not only had he continued to transfer money monthly to his 71-year-old mother in the Philippines, but he also was now sending her even more.

“Part of my motivation to come here was to help support my mom, who put me through med school,” said Go, 46, who arrived in the United States 17 years ago.

.

The money covers her rent, utilities, medical bills and food.

“Given that there are extraordinary circumstances during the pandemic, I send extra so she can buy her medicine ahead of time,” he said. “She also has needed money to buy masks and groceries in bulk because she can’t keep going out.”

Unlike workers who are tied down with homes and families, many immigrants have been able to continue to send money home because they are willing to follow the work.

Working for a company in Maryland that lays asphalt and patches up parking lots for commercial properties, Rafael Romero, an immigrant from Mexico, was earning $1,400 a week before the virus shuttered business after business and his wages shrank by half.

While he usually had sent his parents, children and siblings in Mexico $600 a month, he managed only $300 for three consecutive months this spring. So this month, Romero, 42, traveled 240 miles from his home in Jessup, Maryland, to work in Virginia Beach.

.

“We aren’t going to let down our families who depend on us,” Romero said during a work break with two fellow immigrants, one from Guatemala, the other from El Salvador, who had traveled with him to the area.

Last year, workers abroad pumped more than $100 billion into Latin America, a record. The bulk of it originated in the United States, with Mexico being the biggest recipient.

Often used to purchase essentials like food and medicine, the money is key to alleviating poverty in those countries. But remittances also enable families to afford schooling, household appliances and better housing. In Guatemala, Latin America’s second-largest recipient of U.S.-generated remittances, buildings erected with the help of immigrants in the United States are ubiquitous in Indigenous villages.

To be sure, unemployment among immigrants in the United States has spiked, as it has for the overall population, and the situation has been especially challenging for those who are living in the country without legal permission because they are not eligible for federal assistance. But immigrants with green cards might have been buoyed by unemployment payments, which enabled them to keep sending money abroad.

Some immigrant workers also have been less adversely affected by the pandemic because of the labor they perform. While they are overrepresented in service-sector jobs that have been hardest hit by the downturn, such as hotels and restaurants, foreign-born workers also make up a large share of the workforce in industries that have been spared, such as food processing and agriculture.

.

That helps explain why the total value of remittances during the first six months of 2020 actually climbed in some countries, including Mexico, Nicaragua and the Dominican Republic, by 10%, 5% and 3%, respectively, compared with the same period a year ago.

Guatemala broke monthly records for remittances in June, July and August after seeing declines in the previous three months, suggesting that immigrants might be sending more money to their families to compensate for the earlier shortfall.

The amount transferred to El Salvador sank 40% in April compared with the same month last year but then jumped 10% and 14% in June and July, respectively, compared with those months in 2019.

“People never gave up sending money to their families, and starting in May we began to see steady improvement,” said Oscar Enrique Hinds, remittances manager at Banco Agricola in San Salvador, El Salvador.

Probably as a result of social distancing, the bank has observed more digital transfers from cellphones and computers rather than from money transfer outlets.

“People are sending money without having to stand in line or go to a physical location,” Hinds said.

.

Remittances are also a vital source of hard currency for developing countries, often dwarfing foreign direct investment and foreign aid. Last year, the transfers accounted for 20% of the gross domestic product of El Salvador and Honduras.

The economies of Mexico and most countries in Central America are expected to significantly contract this year, and that could propel more people to emigrate to the United States, analysts said.

Mexico’s president, Andrés Manuel López Obrador, said in late August that money sent by Mexicans living in the United States would be critical to his country’s economic recovery.

“In spite of the pandemic in the United States and also the collapse of the United States economy, remittances that our countrymen send to their relatives have increased, and that reaches 10 million families,” the president said.

Other factors have helped immigrants keep sending money home despite the downturn.

After living through the Great Recession of 2008 and 2009, when remittances ebbed worldwide, many immigrants in the United States had saved for the unexpected, said Manuel Orozco, a remittances scholar who interviewed immigrants, money transfer companies and central banks for recent research.

“The lessons from the recession in 2009 led them to prepare themselves,” Orozco said.

The average savings of Mexican immigrants climbed from $4,000 in 2009 to about $6,000 in 2020, according to his estimates, which helped inoculate them against the sluggish economy.

.

He also found that a heightened threat of deportation under the Trump administration has compelled immigrants living in the United States without legal permission to transfer more money back home, in case they are suddenly detained and unable to access their U.S. assets.

“All this anti-immigrant rhetoric has created a strong sense of fear. Just in case, they are going to send more money to their countries,” said Orozco, who is director of the Center for Migration and Economic Stabilization at Creative Associates International, a development company based in Washington.

Perlera, the port trucker, said he dipped into his savings to keep sending his mother $500 a month when his earnings fell. The money covers living and medical expenses for her and for a younger brother who is disabled.

“I have my wife and two kids here,” Perlera, 38, said. “But I won’t stop helping my mother even if my earnings fall. I’ve been sending my mom money since I arrived in this country 20 years ago.”

This article originally appeared in The New York Times.

© 2020 The New York Times Company

SIGN UP TO RECEIVE OUR EMAIL

.

The most important news of the day about the ASEAN Countries and the world in one email: [email protected]

9.26.2020