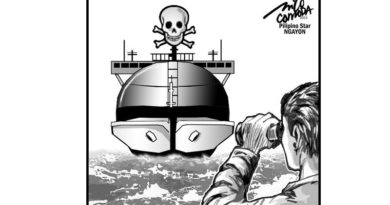

POLITICS: NEW YORK/KUALA LUMPUR- Goldman Sachs fires back after Malaysia charges bank in 1MDB probe

NEW YORK/KUALA LUMPUR: After Malaysia filed criminal charges against Goldman Sachs Group Inc on Monday related to its dealings with the sovereign wealth fund 1Malaysia Development Berhad (1MDB), the investment bank fired back, insisting the previous administration under the Barisan Nasional (BN) Malaysian government had lied to the investment bank.

Authorities charged the bank and two former Goldman employees in connection with an investigation into suspected corruption and money laundering related to the scandal.

Attorney General Tommy Thomas said in a statement that it will seek jail terms as well as billions in fines from Goldman Sachs and four other individuals who allegedly diverted about US$2.7 billion (RM11.28 billion) from 1MDB.

This is the first time Goldman Sachs, which has consistently denied wrongdoing, has faced criminal charges in the 1MDB scandal.

“Certain members of the former Malaysian government and 1MDB lied to Goldman Sachs, outside counsel and others about the use of proceeds from these transactions,“ Goldman spokesman Michael DuVally said in a statement.

“1MDB, whose CEO and Board reported directly to the prime minister at the time, also provided written assurances to Goldman Sachs for each transaction that no intermediaries were involved,“ DuVally said.

Former prime minister Datuk Seri Najib Abdul Razak set up the 1MDB fund in 2009, and the US Justice Department estimated US$4.5 billion (RM19 billion) was misappropriated by high-level fund officials and their associates between 2009 and 2014.

DuVally said the bank was not afforded the chance to be heard before the filing of the charges and will contest the allegations.

The charges do not affect Goldman’s “ability to conduct our current business globally”, he said.

Goldman Sachs shares were down 2.8% at US$167.92 (RM701.74) on the New York Stock Exchange on Monday, the lowest level the storied bank’s stock has sunk to since late September 2016.

Goldman Sachs has been under scrutiny for its role in helping raise US$6.5 billion (RM27 billion) through three bond offerings for 1MDB, which is the subject of investigations in at least six countries.

Analysts said on Monday that investors had expected Malaysian authorities would file charges against Goldman Sachs and that it would seek fines, including the US$600 million (RM2.5 billion) in fees Goldman received for the deal and the allegedly misappropriated US$2.7 billion (RM11.28 billion) bond proceeds.

Malaysia has said it will also seek prison terms of up to 10 years for each of the individuals accused.

“A lot is already priced into Goldman’s shares,“ Jeff Harte, principal equity analyst at Sandler O’Neill & Partners, said in an interview. “Malaysia has been talking for months about potential criminal charges.”

While it is difficult to quantify the impact Malaysia’s charges will have on the bank, it is likely Goldman will increase the amount of money it has dedicated to handling these issues, Harte said.

Analysts have said the bank is likely to boost its legal reserves by as much as US$1 billion (RM4 billion).

The US Justice Department announced criminal charges against two former Goldman bankers, Tim Leissner and Roger Ng, on Nov. 1.

On the same day, prosecutors in the US Attorney’s Office in Brooklyn said Leissner had pleaded guilty to conspiracy to launder money and conspiracy to violate the Foreign Corrupt Practices Act and had agreed to forfeit US$43.7 million (RM183 million).

Ng, detained in Malaysia, is facing extradition to the United States.

John Marzulli, a spokesman for federal prosecutors in Brooklyn, declined to comment on the Malaysian charges.

Goldman Sachs stock has fallen nearly 26% since Nov. 1.

Goldman gets 15% of its revenue from Southeast Asia, which could be at risk if the scandal hurts Goldman’s reputation, according to a report from UBS analyst Brennan Hawken.

.

ADS by Cloud 9:

.

– SPACE RESERVE FOR YOUR ADVERTISEMENT –

.

.

’Commission and abetment’

Thomas said yesterday Malaysia brought criminal charges related to securities law violations against Goldman Sachs, its former bankers Leissner and Ng, former 1MDB employee Jasmine Loo and fugitive financier Low Taek Jho Jho Low Jho Low in connection with the bond offerings.

“The charges arise from the commission and abetment of false or misleading statements by all the accused in order to dishonestly misappropriate … the proceeds of three bonds issued by the subsidiaries of 1MDB, which were arranged and underwritten by Goldman Sachs,“ Thomas said in a statement.

He said the offering statements filed with the regulators contained statements that were false, misleading or with material omissions.

Low, against whom Malaysia brought other 1MDB-related charges earlier in December, has not commented on the 1MDB case and her whereabouts are not known.

Authorities have described Low as a central figure in the suspected fraud, although he has maintained his innocence.

“As has been stated previously, Mr. Low will not submit to any jurisdiction where guilt has been predetermined by politics and there is no independent legal process,“ Low’s spokesman said in a statement. — Reuters

.

ADS by Cloud 9:

.

– SPACE RESERVE FOR YOUR ADVERTISEMENT –

.

.

All photographs, news, editorials, opinions, information, data, others have been taken from the Internet..aseanews.net | [email protected] / For comments, Email to : Aseanews.net