ASEAN: Singapore CEOs more bullish about future than Asean peers

Poll shows Asean bosses less upbeat about global growth and outlook for own countries, but S’pore bucks trend

Singapore bosses are more optimistic than their regional counterparts about the economic outlook in the coming years, according to a new survey.

It found that Asean chief executive officers have become less confident about global growth – as well as the outlook for their own countries – compared with a year earlier.

But Singapore bucked this trend, with company heads here more upbeat about prospects than their global and Asean peers, said the annual survey by professional services firm KPMG.

It polled 1,261 CEOs from around the world, including Asean, seeking to find out about attitudes, priorities and concerns regarding business growth over the next three years.

There were 52 CEOs from Asean polled – 26 from Singapore and the rest from Malaysia, Indonesia, Thailand, the Philippines and Vietnam.

The survey noted that 60 per cent of Asean CEOs are confident about global economic growth over the next three years, down from 80 per cent in the previous year’s poll.

It also revealed that confidence among Asean CEOs regarding their own countries’ three-year growth prospects has fallen from the previous year. The Singapore CEOs polled were, however, more confident not only about the country’s growth prospects compared with their global and regional peers, but also in comparison with the 2016 poll.

Despite uncertainties over the economic outlook, business leaders across the region continue to see strong prospects for their firms.

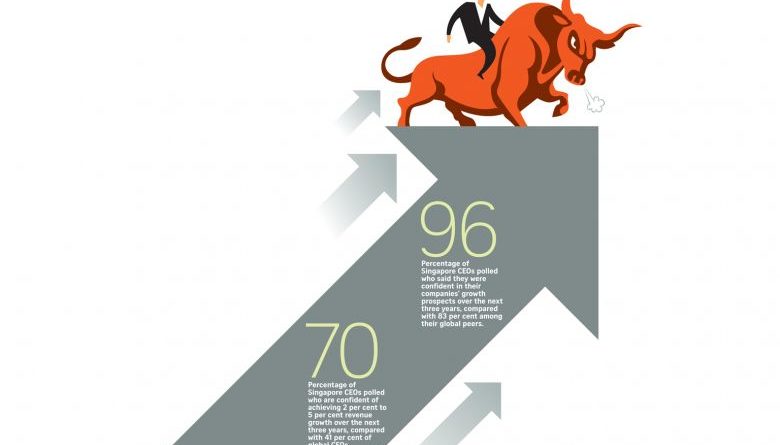

Almost all the Asean CEOs polled – 98 per cent – said they were confident in their companies’ growth prospects over the next three years, with more than half saying they were very confident. For Singapore CEOs, it was 96 per cent.

These numbers are in sharp contrast to their global peers, with a far lower 83 per cent expressing confidence in their own company’s growth prospects over the next three years.

The survey also noted that 62 per cent of Asean head honchos are confident of achieving 2 per cent to 5 per cent revenue growth over the next three years, compared with 41 per cent of global chiefs.

In Singapore, the number is even higher, at 70 per cent.

“After some years of caution, we are now seeing an economic uptick that is driving optimism in Singapore,” said KPMG Singapore managing partner Ong Pang Thye. Some key risks to growth include regional geopolitical uncertainty and the possibility that the bull run in global stocks and bonds might end, he said.

FUTURE IN TECHNOLOGY

As more Singapore companies invest in digital technologies, we expect to see a rise in new opportunities for competitive advantage. Our view is that technology will create new customer experiences and business models, drive operational and cost efficiencies, and enable companies to reach customers outside our geographical boundary.

KPMG SINGAPORE MANAGING PARTNER ONG PANG THYE

The survey also found that 71 per cent of Asean CEOs are struggling to keep pace with the speed of technological advancement – significantly higher compared with the global share of 37 per cent.

Barriers to implementing new technologies include complexity, risks and security concerns, as well as legacy systems.

“As more Singapore companies invest in digital technologies, we expect to see a rise in new opportunities for competitive advantage,” said Mr Ong.

“Our view is that technology will create new customer experiences and business models, drive operational and cost efficiencies, and enable companies to reach customers outside our geographical boundary.

“Technology-related sectors remain a key focus area for Singapore’s future growth. Singapore has seen extremely promising developments in fintech (financial technology), particularly in technologies such as blockchain, artificial intelligence and big data.”

Chia Yan Min

Chia Yan Min