MANILA EDITORIAL & CARTOONS: Presidential reminder: ‘tambay’ is not a crime

7.1. The Daily Tribune – Review selective indictments

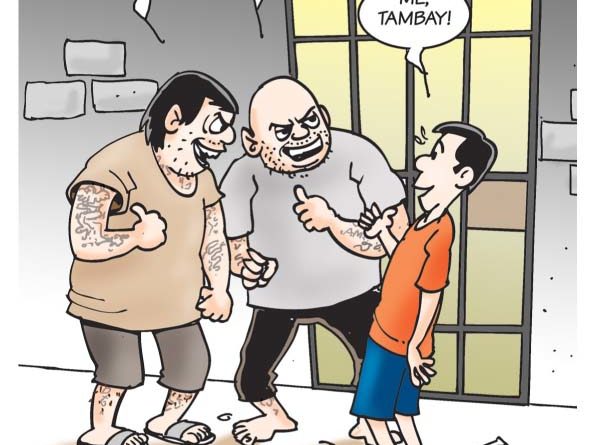

7.2 The Manila Bulletin –Presidential reminder: ‘tambay’ is not a crime

.

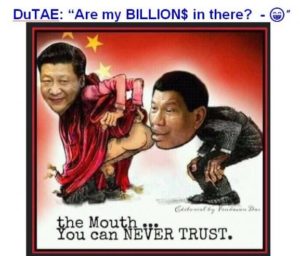

7.3. The Manila Standard –Time to pay the piper

7.5. The Philippine Daily Inquirer –‘Galling decision

7. Dami pa ring kurakot – Pilipino Star Ngayon -ABA-YARI silang LAHAT!

8.1. For The Straits Times

The Straits Times says

Cover gives freelancers peace of mind

Freelancers such as private-hire car drivers, sports coaches and tutors will welcome news that they can now purchase insurance to mitigate the loss of income during long periods of illness or hospitalisation. The first of such products, underwritten by Etiqa and created by local start-up GigaCover, entered the market earlier this month. NTUC Income is reportedly keen on offering a similar scheme. The development should be applauded – even by those who work full-time and whose medical leave is covered by employers – as it represents a contribution to the security of those in the workforce at a time of acute economic disruption. Freelancers who operate in various segments of the economy are particularly vulnerable because of the impact that illness or hospitalisation can have on their earnings. There are more than 223,000 residents who are self-employed. That number has grown, fuelled by new jobs generated by disruptive technology in sectors such as transport and food delivery.

While the creation of these jobs represents the good tidings of the new economy, it means that a larger number of workers may have to step out of the traditional comfort zone of the old economy in the years to come. So it is essential for the workforce as a whole to have recourse to a safety net consisting of programmes such as portable medical insurance for those changing jobs and, now, insurance for freelancers. This way, those making the transition to self-employment will have some peace of mind that they and their families will not suffer badly should they fall ill. Freelancers already face problems such as late payment and overdue wages from firms. They can do without the additional stress of a loss of earnings because of prolonged sickness. Enlightened employers, drawn by the flexibility that freelancers provide to their operations, can make themselves more attractive by buying insurance coverage for freelancers. Should this approach become the industry norm one day, then employers who are slow to react will be less appealing to the growing pool of freelancers. Still, freelancers would do well to step up and insure themselves because such schemes, like insurance schemes generally, need a sufficiently broad base of users to be viable financially. The premiums are not prohibitive and have been calibrated to cater to the varying financial capabilities of freelancers. The structures of assurance that existed in the old economy, and which were based on lifelong employment in a single firm, have been giving way. Credit for now mooting a scheme that meets the need of the times must go to the tripartite work group on protecting the needs of self-employed persons. So too to the companies willing to enter what is still a fringe insurance market. They have shown good initiative as well, very much in keeping with the entrepreneurial spirit of the gig economy.

TO READ THE FULL ARTICLE

All photographs, news, editorials, opinions, information, data, others have been taken from the Internet ..aseanews.net | [email protected] |.For comments, Email to :D’Equalizer | [email protected] | Contributo

All photographs, news, editorials, opinions, information, data, others have been taken from the Internet ..aseanews.net | [email protected] |.For comments, Email to :D’Equalizer | [email protected] | Contributo