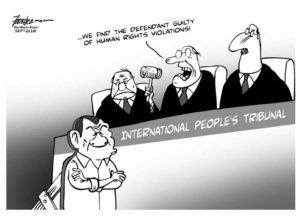

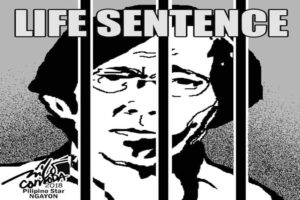

OP ED EDITORIAL & CARTOONS: MANILA- INTERNATIONAL PEOPLE’S TRIBUNAL

7.1. Pushing on a string – Daily Tribune – A better sanctuary

.

7.2. Manila Bulletin –CHANGING WORLD –How agribusiness can eradicate poverty By DR. BERNARDO M. VILLEGAS

Whatever we do to improve the infrastructures for the urban centers of the Philippines through the “Build, Build, Build” program, such as building modern airports, subways, rapid trains, and tollroads, we will not make any significant dent on mass poverty because poverty is fundamentally a rural phenomenon in our country. Development has to happen in the countryside, and especially in the agricultural sector. It is providential that Malaysia is now in the news because of the recent dramatic return of the oldest head of state in the world today in the person of Prime Minister Mahathir who is over 90 years of age. It is the example of Malaysia that can inspire us to implement one of the most effective solutions to rural poverty that the agribusiness sector can offer. Dr. Rolando Dy describes in great detail this outstanding example of an agribusiness model that helped Malaysia reduce poverty from the high of 52.4 percent in 1970 to practically zero today. How did they do it? Let me summarize Dr. Dy’s article entitled “The Dramatic Transformation of Rural Malaysia.”

.

7.3. The Manila Standard – In no mood for rainbows

7.4. The Manila Times – INTERNATIONAL PEOPLE’S TRIBUNAL

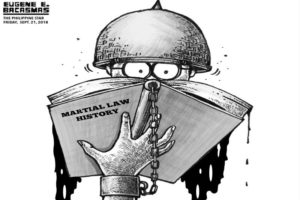

7.6 The Philippine Star – Revisiting martial law

8.0. The Straits Times

The Straits Times says:

Going cashless with consumers’ buy-in

.

Soon after appointing Nets as the single touch point – to supply a unified system at hawker centres, canteens and coffee shops that can accept e-payments from 20 sources – Singapore has taken another step towards the goal of becoming a cashless society. Now, a universal QR code, which allows consumers to scan and transfer funds from 27 e-payment apps, has been launched. Called SGQR, it is the world’s first unified payment QR code which will allow customers to choose from e-payment solutions such as GrabPay, Dash and Nets and enable businesses to accept them. Businesses, on their part, will not need to display multiple QR codes. In the same spirit of building a national cashless system, Fast, which is an instant online interbank funds transfer system, will be opened to non-bank players such as Grab and Razer to allow consumers to transfer funds among more e-wallets.

SGQR is a significant move towards the national goal of creating an interoperable e-payment system that is simple to use. In tandem with other measures, it should help Singaporeans leverage technology to increase the convenience with which they go about their everyday economic lives. As the Monetary Authority of Singapore notes, the SGQR is based on a system that possesses the benefits of international interoperability, multi-tenancy of QR schemes and non-sensitive data presented for payments. SGQR customises these standards for the Singapore market, thereby simplifying QR e-payments in Singapore for both consumers and merchants. Indeed, it is an important move against the proliferation of proprietary QR codes at merchants, which could result in the fragmentation of payment solutions and contribute to inefficiency among both merchants and consumers. For SGQR to work well, both merchants and customers must buy into the scheme. That hardly is a matter of choice for the former since they will have to adjust to customers’ demands. It is the latter group that must embrace the new system.

TO READ THE FULL ARTICLE: https://www.straitstimes.com/opinion/st-editorial/going-cashless-with-consumers-buy-in

.

All photographs, news, editorials, opinions, information, data, others have been taken from the Internet ..aseanews.net | [email protected] |.For comments, Email to :D’Equalizer | [email protected] | Contributor

All photographs, news, editorials, opinions, information, data, others have been taken from the Internet ..aseanews.net | [email protected] |.For comments, Email to :D’Equalizer | [email protected] | Contributor