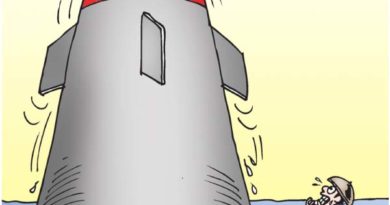

EDITORIAL: Tinderbox region

ADS by Cloud 9:

.

– SPACE RESERVE FOR YOUR ADVERTISEMENT –

Fortunately, the incident did not elicit immediate response from Saudi Arabia and the United States. The US has blamed Iran for the attacks despite the claim of Iran-backed Houthi rebels in Yemen that they were responsible for the assaults.

Oil prices in the world market stayed near $60 a barrel after hovering just above $50 in recent weeks prior to the attacks on Saudi Arabia. The prices seem to be holding, but oil traders are understandably nervous and monitoring closely the development in the tinderbox region.

ADS by Cloud 9:

.

– SPACE RESERVE FOR YOUR ADVERTISEMENT –

The Philippines, meanwhile, has remained conservative on its assumption of oil prices relative to its inflation rate target. Bangko Sentral ng Pililipinas Governor Benjamin Diokno said the government would stay within its inflation target of 2 percent to 4 percent in 2019 as long as oil prices did not exceed $85 per barrel.But the Philippines’ macro-economic assumptions could easily backfire if the Middle East situation deteriorates, or if the US and its allies in the region launch a counter-attack on Iran. Oil prices in the world market could then surge to as high as $100 a barrel if the situation escalates and draws other nations to the conflict.Prolonged high oil prices will induce a slowdown in the global economy that will adversely affect developing countries like the Philippines.The geopolitical tensions in the oil-rich Middle East are also a reminder that countries heavily dependent on imported oil should continue their program to exploit non-fossil fuels and renewable sources of energy. The conflict in the Middle East has no short-term solution yet and no country can control the vagaries of oil prices.

ADS by Cloud 9:

.

– SPACE RESERVE FOR YOUR ADVERTISEMENT –

.

All photographs, news, editorials, opinions, information, data, others have been taken from the Internet ..aseanews.net | [email protected]

All photographs, news, editorials, opinions, information, data, others have been taken from the Internet ..aseanews.net | [email protected]

For comments, Email to :D’Equalizer | [email protected] | Contributor