ASEANEWS HEADLINE-ECONOMY | Singapore tax revenue rises 17% to $80.3 billion amid wage and economic growth

.

In the financial year covering April 2023 to March 2024, the Inland Revenue Authority of Singapore collected a total of $80.3 billion. PHOTO: ST FILE

.

.

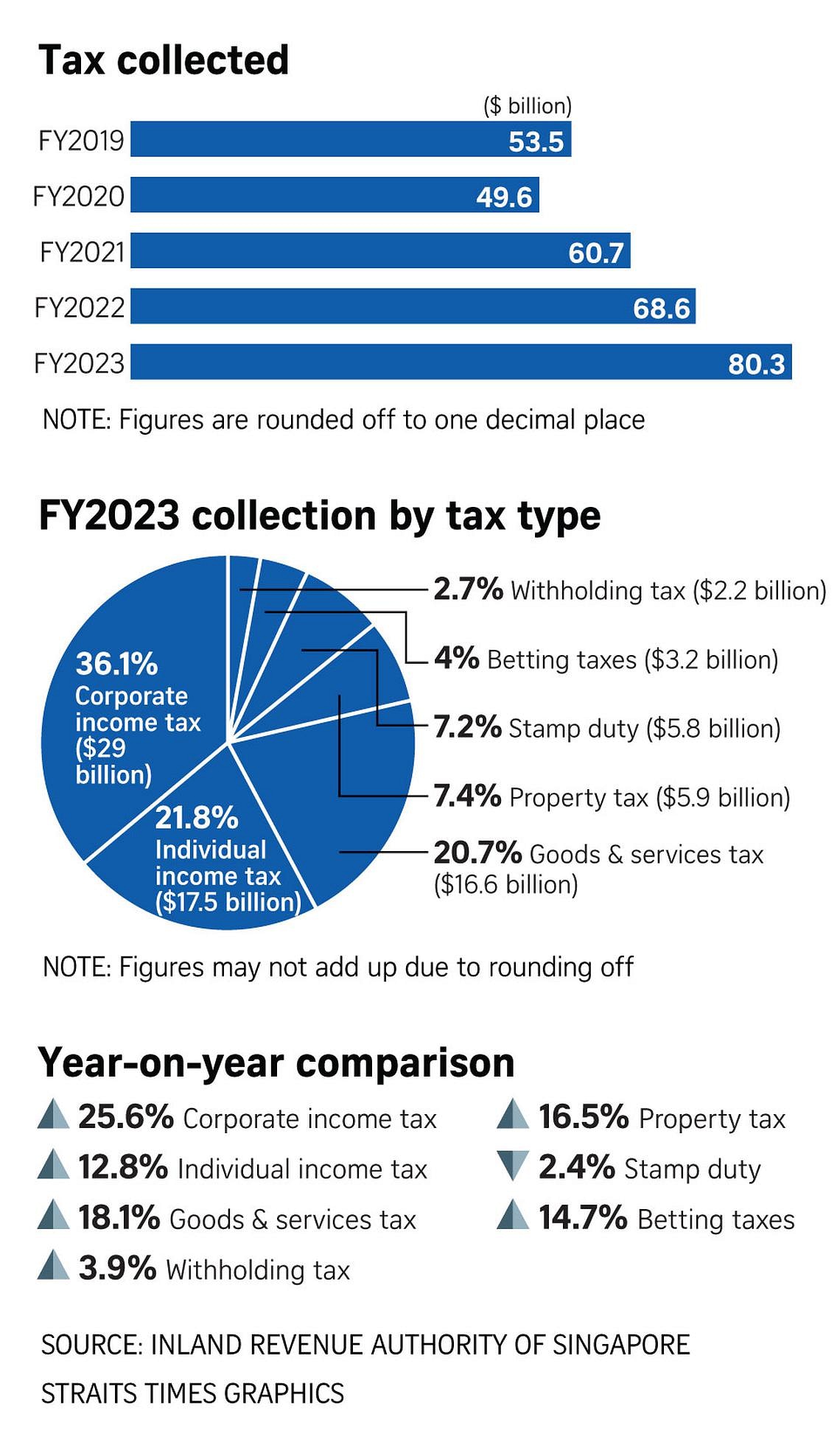

SINGAPORE – Tax collection in Singapore rose by 17 per cent, continuing an upward trajectory on the back of economic growth and higher nominal wages.

In the financial year covering April 2023 to March 2024, the Inland Revenue Authority of Singapore (Iras) collected a total of $80.3 billion. This is 17 per cent higher than the $68.6 billion collected from April 2022 to March 2023.

The latest amount represented 77.6 per cent of the Government’s operating revenue and 11.9 per cent of Singapore’s gross domestic product, said Iras on Sept 4.

While tax compliance remains high in Singapore, Iras said it remains vigilant and will take firm action against the small minority of taxpayers who do not comply with paying their taxes.

The tax authority said it audited and investigated 9,590 cases in the latest financial year, and recovered about $857 million in taxes and penalties. This was up from around $500 million in taxes and penalties it recovered in the previous financial year.

Tax revenue collection increased across most tax types, with corporate income tax growing by $5.9 billion to reach $29 billion due to strong corporate earnings.

It made up the largest share of Iras’ revenue collection, at 36.1 per cent, up from 33.7 per cent in the previous financial year.

Meanwhile, individual income tax rose by $2 billion to hit $17.5 billion on the back of higher wages and an increase in the number of taxpayers. It accounted for 21.8 per cent of total collection.

Goods and services tax (GST) revenue accounted for the third-largest share of Iras’ revenue collection, at 20.7 per cent, or $16.6 billion, rising by $2.6 billion due to higher consumer spending and the increase in the GST rate from 8 per cent to 9 per cent on Jan 1, 2024.

Property tax contributed 7.4 per cent, or $5.9 billion.

Stamp duty collection, however, fell by $100 million due to lower property transaction volumes. It accounted for 7.2 per cent, or $5.8 billion, of the revenue collection.

“The taxes collected are used to fund essential services for our community, grow our economy, enhance our living environment, as well as support social development programmes to improve the lives of Singaporeans,” said Iras.

.

In the latest financial year, the taxman processed about $2.3 billion in grants that were disbursed to more than 131,000 businesses. These grants came under various initiatives, such as the Progressive Wage Credit Scheme.

.

About $1.67 billion was disbursed under the enhanced scheme to provide transitional wage support for more than 81,000 employers, with higher government co-funding for lower-wage workers.

Iras said it continues to work with solution providers and stakeholders to develop application programming interfaces, or APIs, so that more businesses can perform tax transactions directly from their accounting and payroll software.

For example, the authority will require GST-registered businesses to adopt InvoiceNow, which transmits invoice data to Iras for tax administration.

This will be done in phases, starting with newly incorporated companies that voluntarily register for GST from November 2025, and all new voluntary GST registrants from April 2026.

.

Memento Maxima Digital Marketing

Memento Maxima Digital Marketing